Blog

Welcome to The Formations Company Blog. Here we’ll share the latest news and helpful tips to make starting your business a little easier. Whether you’re looking for information on how to chase an invoice, tax, marketing your business or just looking for inspiration, there’s something here for everyone.

Current Issues UK SME’s have, what’s being done and what you can do

Across nearly every news channel you’ll see the endless list of worries that households are facing right now. Whilst households are struggling, what isn’t being covered so much is the fact that the same issues are have a huge negative affect on small businesses in...

Pay rates recap for limited company owners

In this blog post, we’ll recap the annual increase to statutory pay rates, which include the National Minimum Wage and the statutory sick, maternity and paternity ay and more. If your limited company has employees, it’s important to make sure that you keep...

National Insurance: Increase to Primary Threshold – Good for limited company owners?

Rishi Sunak announced yesterday (23/03/2022) that the Class 1 Primary and Secondary National Insurance threshold will rise from £9,880 to £12,570 in July. Sunak described this tax cut as the “largest single personal tax cut in decades” and a “tax cut that...

Recovery Loan Scheme extension to 30 June 2022

If you’re in need of finance to recover from the rippling effects of COVID-19, don’t forget that the government Recovery Loan Scheme has been extended to 30 June 2022 but there are some key changes that you will need to be aware of. The first is that the...

Plastic Packaging Tax – Is your business affected?

As of 1 April 2022, the government will be introducing a tax on plastic packaging. The objective of this increase is to give businesses a clear economic incentive to use recycled plastics and ultimately increase levels of recycling and divert away from landfill. IN...

What the rise in National Insurance means for businesses

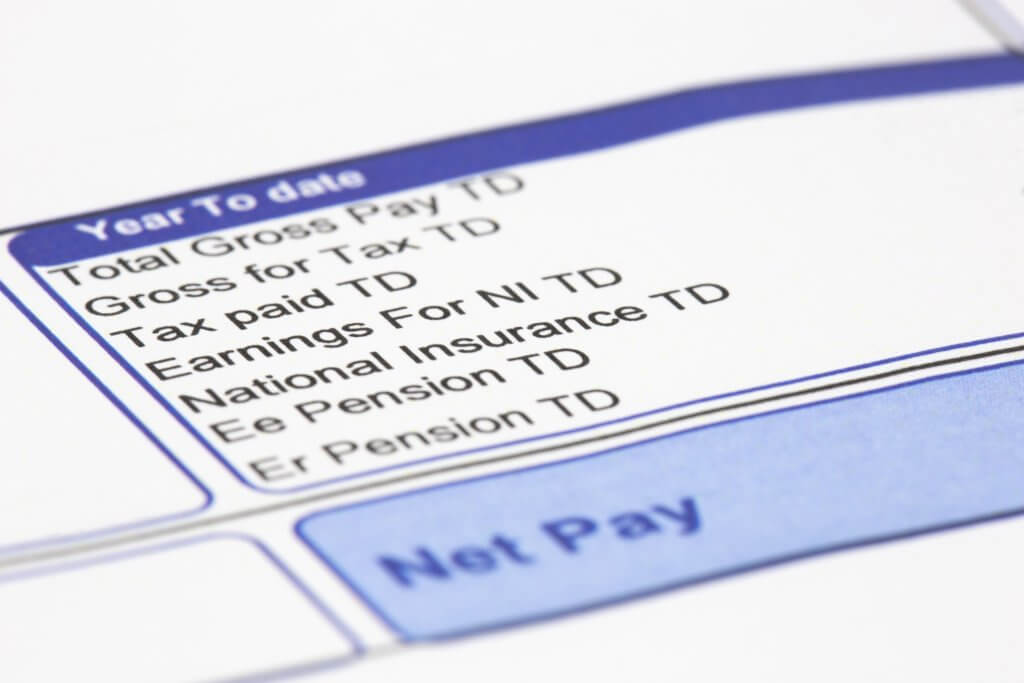

From April 6 2022 to April 5 2023, National Insurance contributions (NICs) will increase by 1.25% for both Employee and Employer contributions. Known as the Health and Social Care Levy, this money will be spent on the NHS, health and social care in the UK. ...

New employee digital ID checking rules

As of April 6th 2022, the Home Office is outsourcing digital ID checking. This means that for any employee digital checks, businesses will have to use an approved third-party software which could cost between £1.50 and £70 per employee! Previously, employee...

Self-assessment tax return for limited company directors

As a director of a limited company, you may have to carry out a self-assessment tax return. This is to tell HMRC how much money you’ve earned in a year and any other financial information. HMRC collect this information to work out how much tax and National...

Making Tax Digital – Post 1st January

Now the 1st Jan has been and gone, in accordance with the new Making Tax Digital (MTD) requirements, if you’ve registered your company for VAT because your company is over the VAT threshold of a taxable turnover of over £85,000, or even if you have voluntarily...

New Powers for the Insolvency Service

The insolvency Service has had its powers extended on behalf of the Business Secretary to help tackle directors who dissolve companies to avoid paying their liabilities from Government-backed loans they took during the Covid-19. Previously the Insolvency...